How Chinese Game Developers Can Grow Their Gaming Apps Overseas

China is the largest gaming market in the world, generating over 31% of global mobile gaming revenue, according to Niko Partners. Take a look at the top grossing mobile games for 2023, and you’ll find four of the top 10 titles were developed by Chinese companies such as Tencent and Mihoyo, with Tencent’s Honor of Kings being the mobile market’s biggest earner at $1.48 billion. This figure is even more remarkable considering that Honor of Kings was only released globally in June 2024, meaning most of 2023’s revenue came from China.

With that in mind, the biggest growth opportunities facing Chinese game developers are in markets outside China, echoed by the global rollout of games such as Honor of Kings. But adapting regionalized games for global audiences isn’t without its challenges. In 2023, titles from Chinese developers saw a 5.65% decrease in revenue, around $16.36 billion, according to Gizmochina. Japan, Korea, and the US still make up more than half of China’s revenue from other countries.

There are expansion opportunities, but how can Chinese game developers succeed in new markets?

A focused strategy and a hyperlocalized approach to user acquisition that speaks to target markets are needed. That also means knowing which gameplay and monetization trends are proving popular in markets outside China.

It’s a lot to keep track of.

Our 2024 Guide to Growing Chinese Mobile Gaming Apps Overseas Report, featuring data from ad intelligence platform SocialPeta, provides winning tips for Chinese game developers looking to expand their games overseas. It covers everything from cost-effective advertising strategies to monetization and design trends.

Check out notable report highlights below, and download the complete guide for an in-depth analysis of everything you need to know about growing Chinese-developed mobile games in new markets.

Launch UA campaigns in cost-effective markets

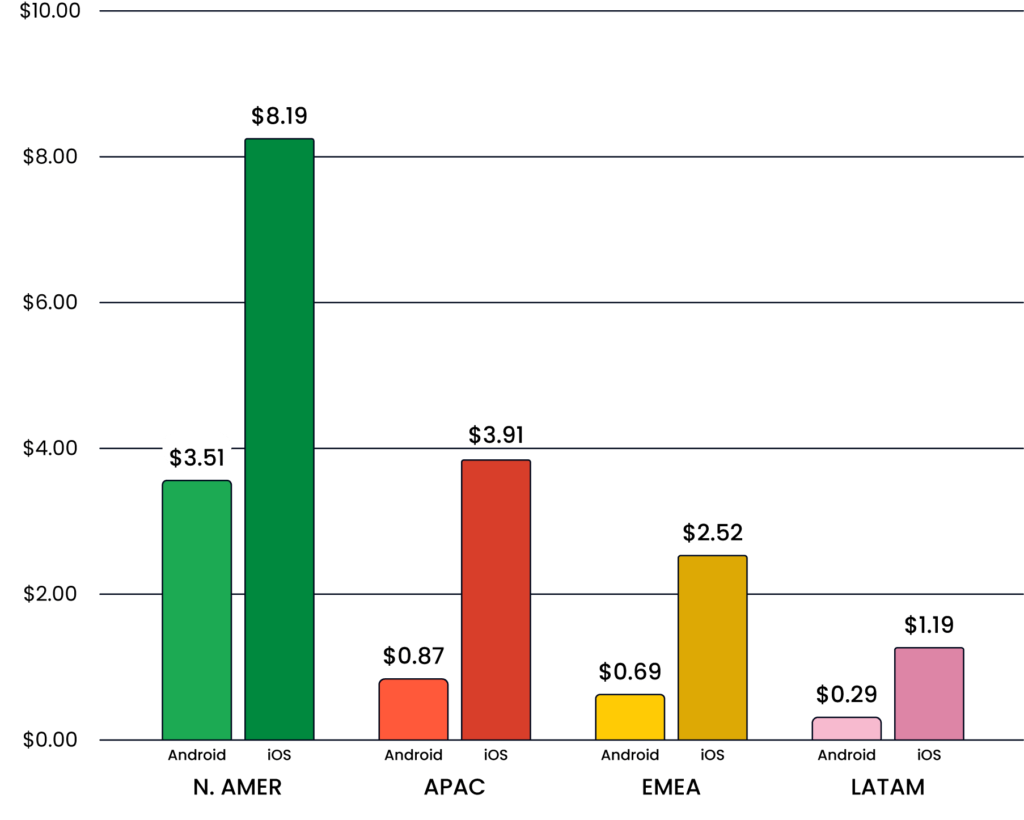

The competitive nature of the North American market means that the cost per install (CPI) is much higher than that of other markets such as APAC, EMEA, and LATAM. CPI for Chinese-grown games is over 2x higher in North America than in APAC, with a CPI of $8.19 (iOS) compared to $3.91 in APAC. In EMEA, CPI is $0.69 on Android and $2.52 on iOS.

In terms of specific countries, it’s once again the most competitive countries that have higher CPIs: Korea ($8.02), the US ($7.68), and Japan ($7.27) have the highest average CPI, while the Philippines ($0.67), Brazil ($0.69), and Mexico ($1.03) have the lowest CPI. Of course, you shouldn’t ignore competitive markets like the US and Korea, as they’re essential to building loyal player bases. However, this competitiveness means North America has a lower day 7 return on ad spend (D7 ROAS) at 14.1%.

With that in mind, the low CPIs in other markets shouldn’t be overlooked, especially in countries such as Brazil, which Honor of Kings chose as the first stop on its global rollout. Brazil, Mexico, and LATAM generally remain cost-effective for UA campaigns.

Engage new players with video ads

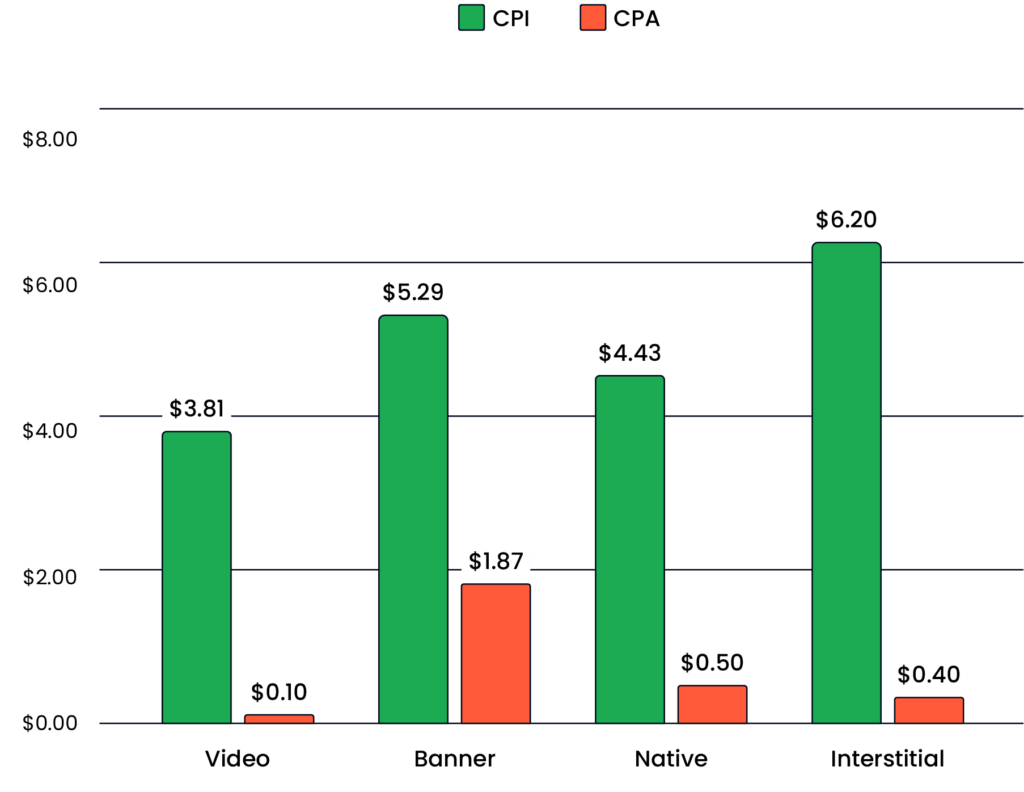

We’ve highlighted which countries and markets are the most cost-effective to target, but how will you do so? Our analysis of Chinese games across all markets found that video ads have the lowest CPI ($3.81) and CPA ($0.10) by ad format (when compared against banner, native, and interstitial ads). Video ads also offer the highest D7 ROAS at 20.9%.

Of course, it’s worth remembering that video ads are more costly to produce than interstitial and banner ads. But the engaging nature of video ads and their compatibility with playable elements mean they’re a highly effective way of acquiring new players. Analysis of the ad strategy for the Chinese mobile game Last War Survival found that 86.1% of its ads from July 2023-2024 were video.

If you’re looking to grow a Chinese game overseas with video ads, we recommend:

- Make your game’s core gameplay a centerpiece of the ad, as Liftoff research finds that showing off core gameplay drives higher ROAS.

- If you’re showcasing gameplay, consider incorporating challenge elements into your video ad. Many players are motivated by a new challenge, and showcasing a minigame within your game is an easy way to do this.

- Work with local influencers in your target market to make your game more appealing. Liftoff UGC creatives increased ROAS by 4x when tested against branded content.

When it comes to stylistic features, think regional

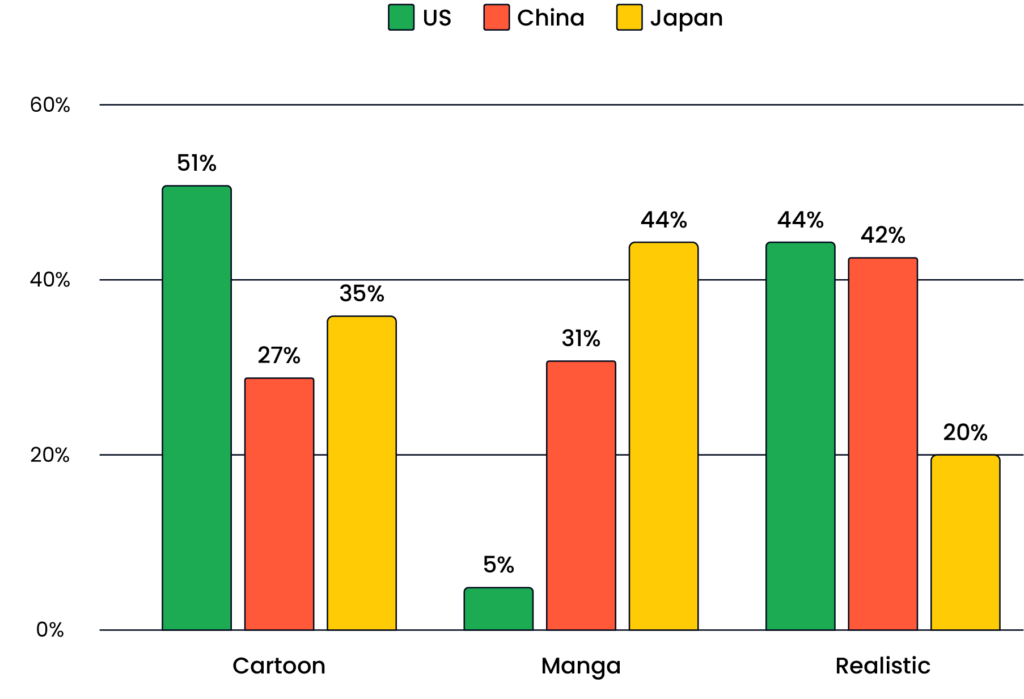

Aesthetic preferences vary across countries, so it’s important to consider them when making stylistic choices in-game and for UA campaigns. Realistic graphics are more popular in China, followed by manga and cartoon styles. In comparison, US players prefer cartoon images, followed by realistic and manga.

As cartoon-style graphics are more popular in the US than in any other market, if the US is a key target market for you, you should consider incorporating cartoon elements into marketing or future game assets as part of your localization efforts.

Incorporate trending gameplay and monetization features

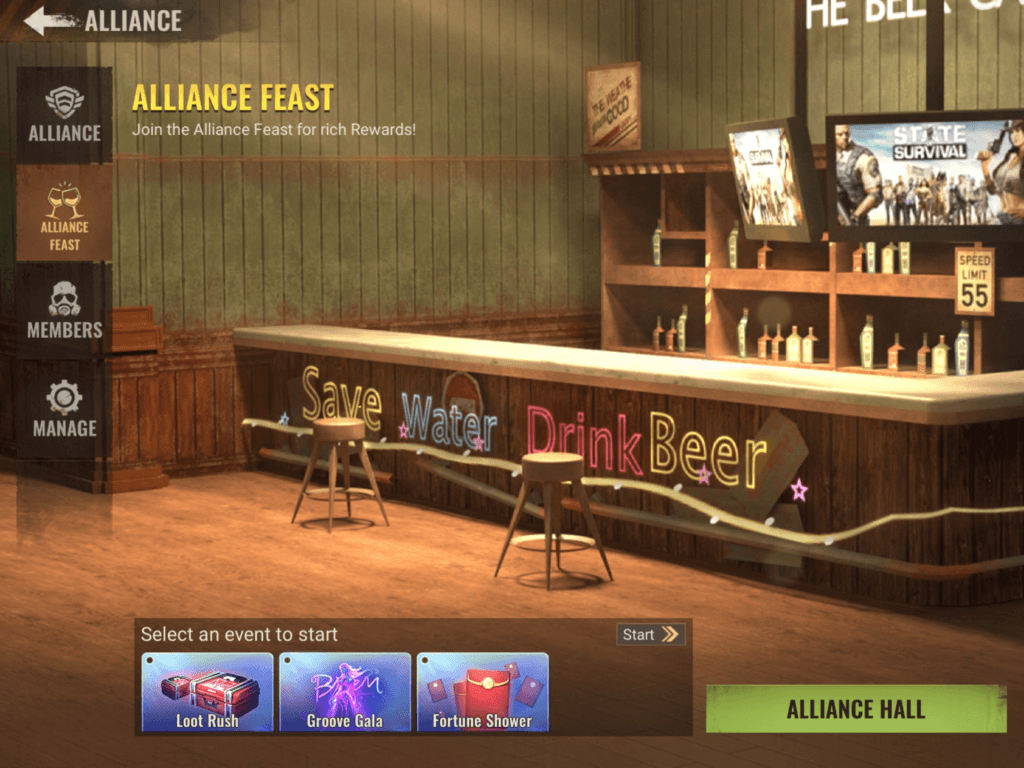

Social hangouts and home systems are two trending gameplay features being utilized by Chinese games that have found success overseas. State of Survival uses the ‘Alliance Hall’ as its social hangout space, where players can plan social events, decorate, and interact with other players.

The home system in Tencent’s PUBG: Mobile lets players build, decorate, and customize their islands and homes by using currency to purchase furniture and upgrades. This feature also incorporates social elements, as players can visit other player islands and engage in events.

On the monetization front, trial characters, trial items, and gacha innovation are proving particularly popular in Chinese RPGs, shooters, and 4X strategy games that have succeeded in markets outside China.

Trial versions of characters and items allow players to experience IAPs before buying, which can be particularly useful if players need some convincing on higher-spend characters or items. In Genshin Impact and AFK Arena, players can own characters for a period of time with temporary trials, but permanent ownership requires a purchase.

Alternatively, some Chinese games let players rent characters for a specific period using in-game currency, adding more depth and customization for monetization.

Innovative examples of gachas include:

- For box gachas, each pull removes an item from the pool, making subsequent pulls more attractive.

- In-event shops grant players a special currency for making gacha pulls, which they can then use in a dedicated shop.

- Players can be rewarded for gacha pull milestones after pulling the gacha a set number of times.