Maximizing Conversions and ROI: Key Insights from Liftoff’s Non-Gaming Ad Monetization Trends Report

Gaming apps have historically used ads to monetize their apps, but now, more and more non-gaming “consumer” apps are moving away from subscription-only models and utilizing in-app advertising to maximize and diversify their revenue streams. In fact, Sensor Tower projects that non-gaming apps will outpace mobile game revenue share by 2026.

So, what caused the turnaround? Many non-gaming apps have always relied on premium subscriptions to generate revenue, which has various drawbacks. For example, users are prone to churning if they don’t see enough value from subscriptions, and many people now suffer from “subscriber fatigue”—when they have too many subscriptions to different services at once. But now, marketers are monetizing the time users spend engaging with apps with in-app advertising (IAA).

Not only has this diversified their revenue streams beyond paywalls and subscriptions, but it’s also enabled them to monetize their entire user base—regardless of whether they are willing to pay. Over 90% of app users want a free app experience, so in-app ads are the only way to monetize these free users. We’ve seen the impact of this tactic first-hand, with ad revenue from non-gaming app publishers on the Vungle Exchange increasing by 116% between September 2023 and October 2024.

increased substantially from Oct 2023 to Oct 2024.

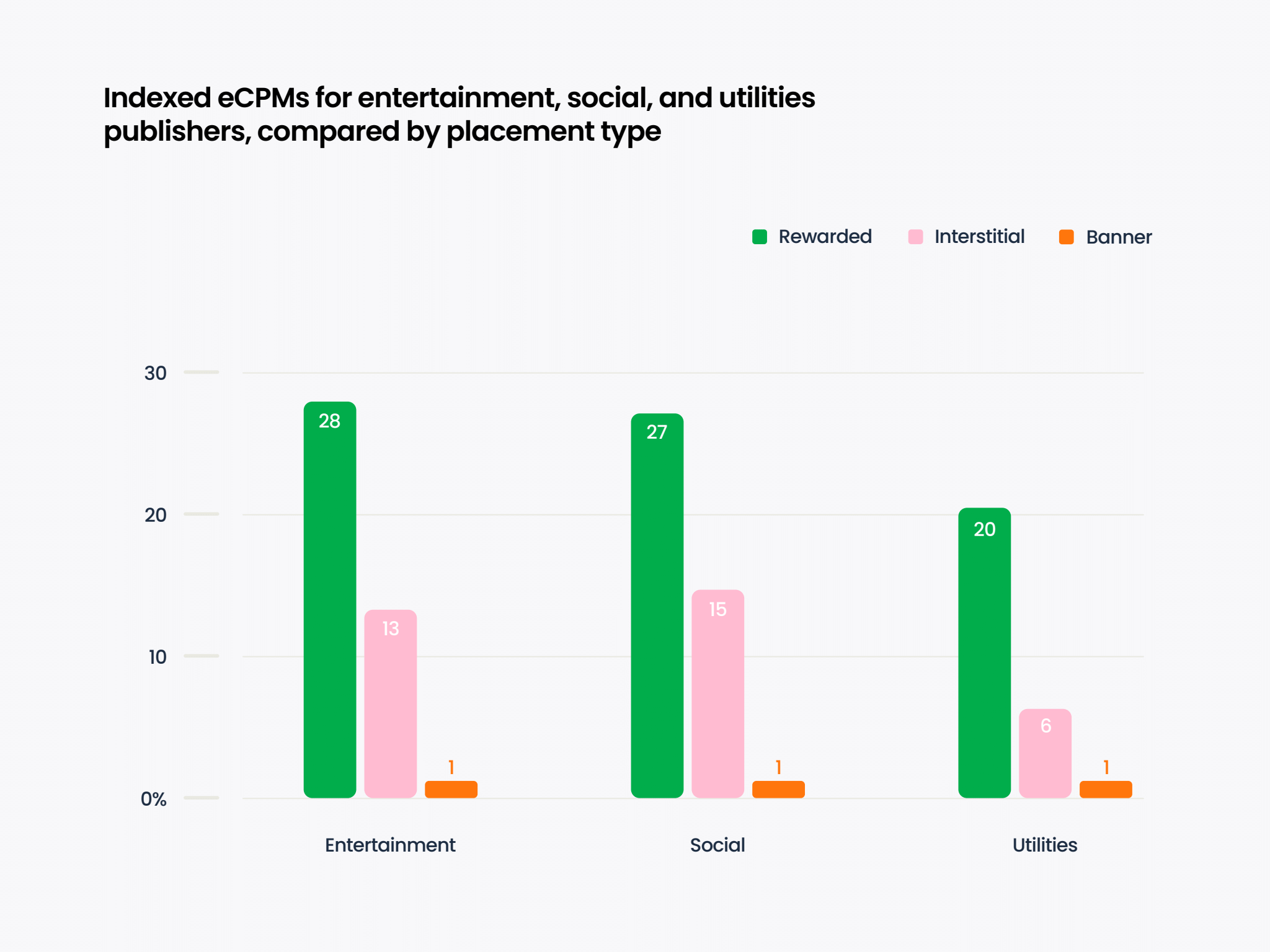

It’s a great start, but what else can mobile developers do to maximize revenue and improve their eCPMs? The answers lie in our Non-Gaming Ad Monetization Trends Report, which shows that incentivizing engagement with rewarded ads, diversifying ad placement types, and balancing ads with UX can all lead to more conversions and higher returns.

The importance of diversifying ads

Placement and viewability are the two most significant factors impacting ad revenue, but many app developers find it challenging to balance the two. Some aim to make their ad placements as unintrusive as possible, which preserves the user experience but also limits their overall visibility. Others opt for more impact with flashier formats like video ads, which are more engaging but have a higher chance of reducing retention rates.

But why not have the best of all worlds? By utilizing a diverse range of ad placements and formats, app developers can find a balance that meets their specific audience’s specific preferences and behaviors. Let’s look at some ways non-gaming app developers can diversify their advertising mix.

Triple-page ads

Triple-page ads blend the best aspects of video, static, and playable ads into a single ad impression, with three full-screen formats that appear during app transitions. This allows for a comprehensive look at the ad they’re displaying, and having three pages also gives a user three unique opportunities to engage with the ad.

The results speak for themselves. With Liftoff Monetize, we’ve seen this ad placement increase user engagement and improve campaign performance, with an up to 10% improvement in app install performance in triple-page ads compared to double-page and video and end-card ad experiences.

Rewarded ads

Rewarded ads have always performed exceptionally well within gaming apps, as most users are happy to part with a fraction of their time to engage with an ad in exchange for in-game premium items. But now, many non-gaming app publishers are also seeing success with rewarded ads, benefitting from higher ad revenue, improved retention rates, and reduced dissatisfaction with ads.

higher average eCPMs from rewarded ads.

The secret to getting high returns from rewarded ads is strong incentives. Whatever you’re offering should be good enough to motivate users to continue a session or try a new feature. For example, a VPN app might offer temporarily expanded bandwidth, a crypto app might provide credits for a trade, and a fitness app might provide temporary access to features normally locked behind a paywall.

Rewarded ads are also particularly effective in apps that encourage (daily) engagement and habitual use. Productivity and utilities apps, for example, can have daily streak systems that involve daily tasks and integrate rewarded ads.

Consider gaming ads in non-gaming apps

Many still think that gaming ads and non-gaming publishers shouldn’t mix, but that’s no longer true. Gamers used to be a pretty select group, but the market has expanded dramatically over the past few years. Most of the US population plays a digital game via any device at least once per month, so it doesn’t make much sense to try to divide gamers and non-gamers into separate groups anymore.

Additionally, the competitive nature of the mobile gaming market means many titles have highly developed advertising strategies and sophisticated approaches to ad creatives. It’s not uncommon for publishers to see an improvement in ad revenue with little impact on retention after incorporating gaming ads in their supply. Plus, gaming demand uses the same ad networks as other advertisers, so you can continue to use your same, trusted demand sources that protect your brand.

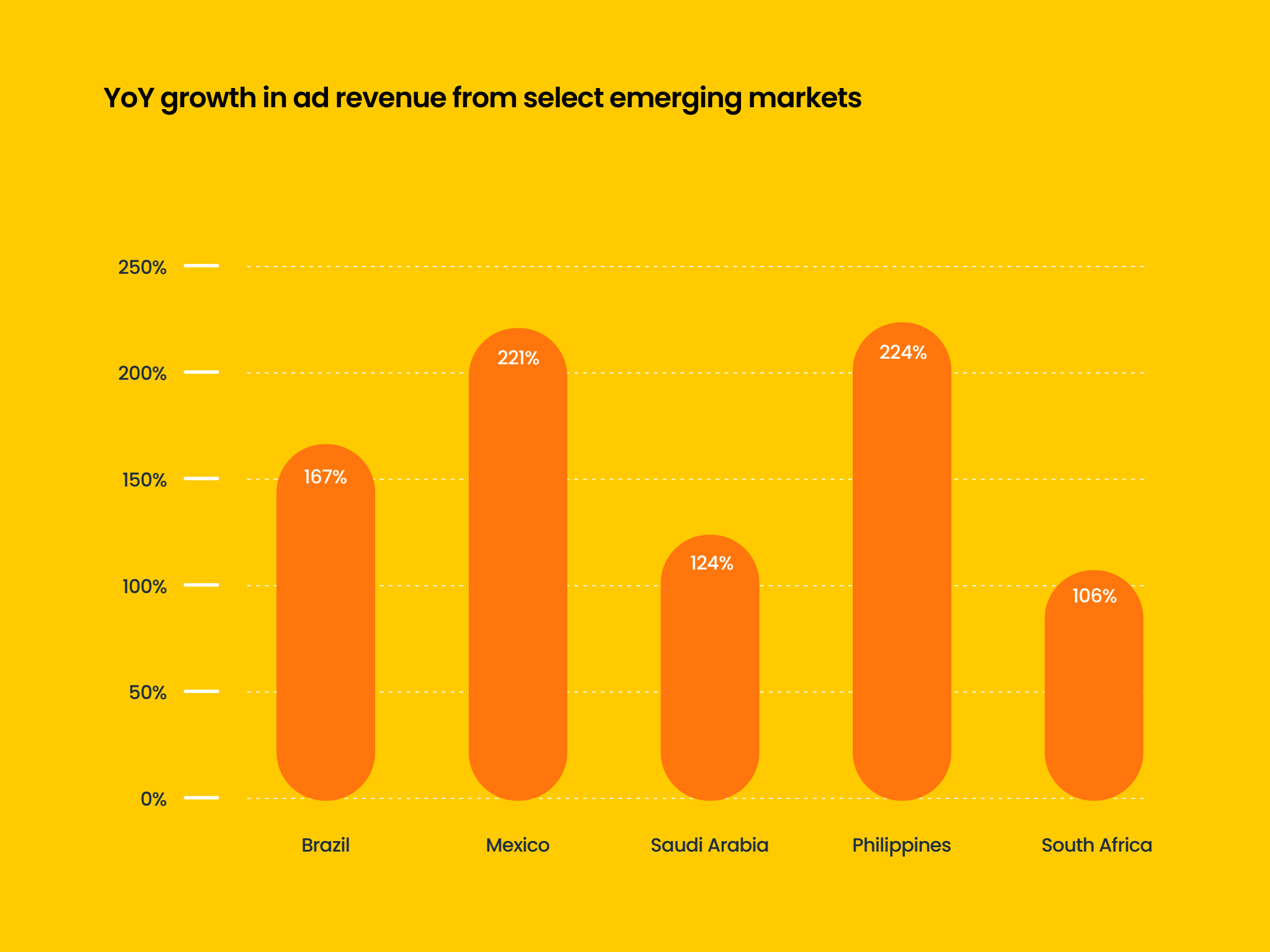

Bonus tip: Look at emerging markets

Over the past year, we’ve seen ad revenue from emerging markets grow significantly on the Vungle Exchange. Mexico and the Philippines increased by more than 200%, Brazil grew by 160%, while Saudi Arabia and South Africa rose by over 100%. While tier-one markets like the US generally offer better eCPMs for most publisher categories, eCPMs in emerging markets can be surprisingly high—and maybe a worthwhile pursuit for many non-gaming app publishers.

Brazil, Mexico, Saudi Arabia, the Philippines, and South Africa.

Achieve higher eCPMs with these new placement types

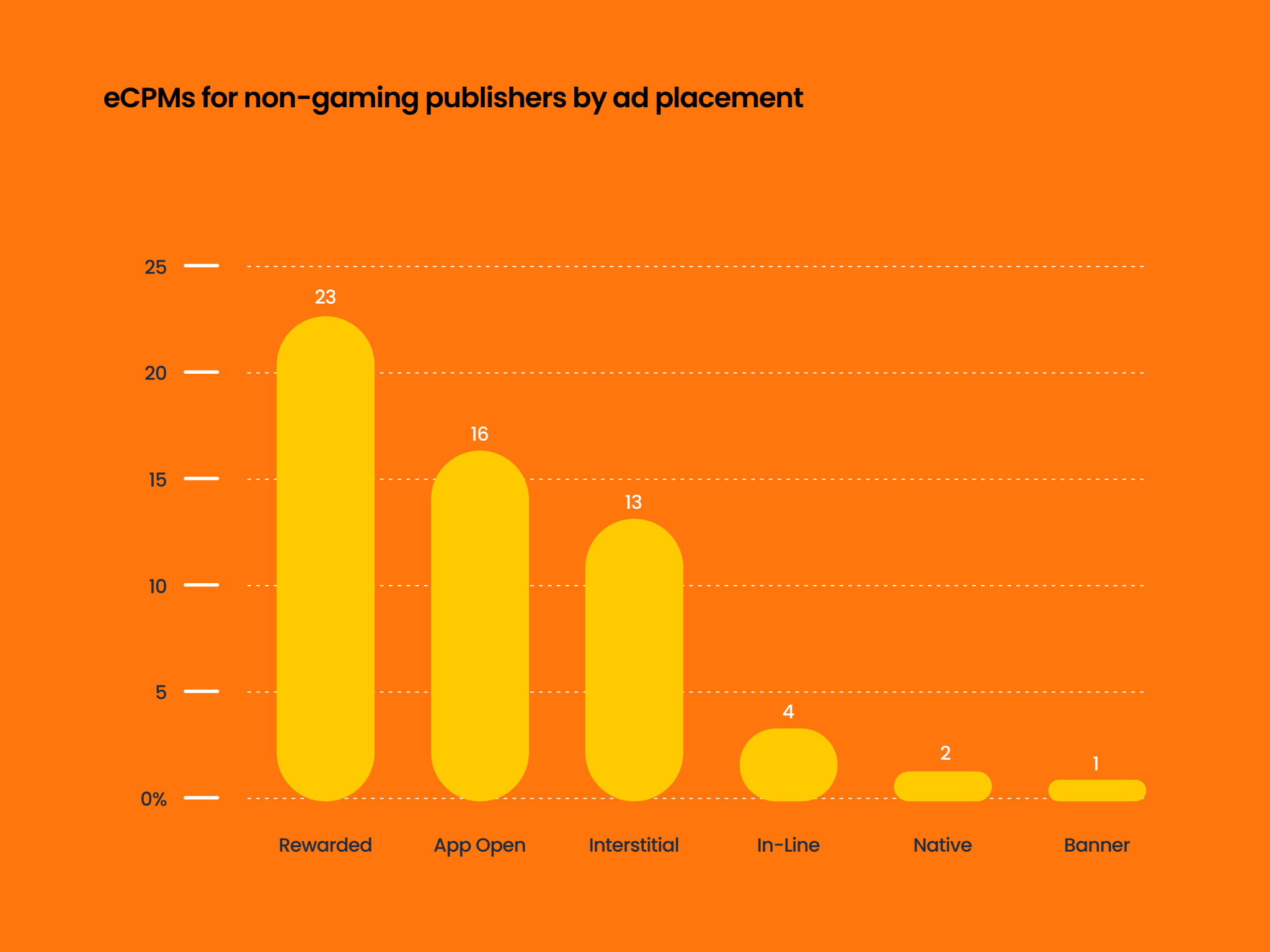

If you’re looking for even more ways to maximize your ad revenue, the Vungle SDK offers two new ad placement types that’ll do just the thing. The first is in-line ads—these function like a static native ad but seamlessly integrate videos to boost eCPMs. The second placement, app open ads, follows the same logic. It sees a video ad displayed as a user opens an app at launch or when a session is resumed, minimizing disruption.

That combination of highly engaging video ads and the less disruptive nature of a native ad means that these two ad formats result in a notable performance increase. Vungle data shows that the average eCPMs for app open ads is eight times that of static native ads, second only to rewarded ads. Meanwhile, in-line ads deliver eCPM twice that of native ads.

One non-gaming app that has experienced the impact of app open ads first-hand is the global music streaming platform Audiomack. After integrating the placement last year, the app saw a 50% increase in Revenue Per Request (RPR) in tier 1 markets without any noticeable impact on retention or churn rates. Likewise, leading commuter app Moovit saw some equally impressive gains after integration with Liftoff’s In-Line Ads, including a 17.8% eCPM increase, 18.4% revenue uplift, and 22.6% ARPDAU growth.

according to Vungle data.

If you’d like to learn more about the growth of non-gaming app ad monetization, read our full report for free here.