The State of User Targeting in the Mobile Marketing World

If there is one thing that differentiates performance marketers of games and non-gaming apps, it’s the channel considerations they make when allocating their ad spend. A majority of mobile performance marketing is dominated by casual gaming advertisers with the benefit of a wide ranging audience. Casual gamers are made up of nearly any demographic and can be found anywhere.

However, non-gaming app marketers require more granular targeting capabilities when spending on new user acquisition channels. For instance, dating apps typically want to acquire users who are mature and single and must be more careful when buying users from publishers with a wide demographic range, such as gaming apps.

As for location, non-gaming app marketers want insight into where their dollars are going. Brands such as Lyft and Uber probably don’t want to pour money into an ad campaign targeting rural North Dakota, they want their campaigns focused on high-density cities with a large population of drivers and public transit users.

For app marketers to reach high-quality users that meet their target demographic, it’s critical to thoroughly understand and select the right acquisition channels.

Choosing the best channels for your app

Utilizing the right channels is the key to generating quality users, but with so many to choose from, where do you start?

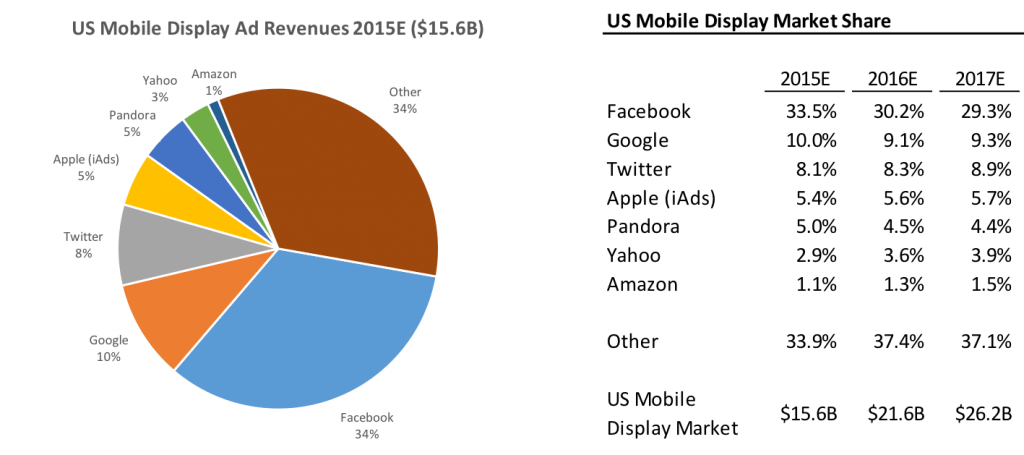

Let’s begin by analyzing the mobile display ad market share in the US, where two things stick out: Facebook has a huge share of the market, but there is also a significant amount of “other” revenue, largely made up of traditional ad networks and DSPs. What this means is that by diversifying your user acquisition efforts outside social media, you can reach a significant number of unique users relevant to your product.

Sources: www.emarketer.com/Article/Facebook-Twitter-Will-Take-33-Share-of-US-Digital-Display-Market-by-2017/1012274

www.emarketer.com/Article/Mobile-Account-More-than-Half-of-Digital-Ad-Spending-2015/1012930

Six factors to consider before starting a new campaign

To ensure that I’m effectively utilizing my time when testing new channels for the Match Group, I review the following six factors before beginning any new campaign:

Scale – You have limited time and resources. Does the source give you access to a significant volume of unique inventory in the geos you desire?

Inventory source – Are the publishers directly integrated or exclusive? Is it indirectly acquired or through mobile exchanges? It’s important to understand if it overlaps with your current activities.

Targeting capabilities – Critical when you have a specific audience. Can they target demographic, device, OS, location, interest, or any other unique targeting (such as intent)?

Creative units – What formats are they strong at? Static, animated, video, rich media, native, and rewarded ads each have different strengths and weaknesses to me, and it’s important to know where I can use them.

Reporting – Publishers have varying levels of reporting sophistication and transparency. Typically, the more transparent my partners are, the more willing I am to run with them.

Everything else – It’s also important to consider other factors such as the buying model (CPI/CPC/CPM), management (self-serve or fully managed), attribution policy, creative resources, and even office time zone.

Before you start a new campaign, define your acquisition objectives so you can focus your efforts. Once you know exactly what you’re looking for, whether it’s a unique publisher or captivating storytelling media, it’s time to take a look at the available channels and how they stack up against your needs.

User acquisition channel strengths and weaknesses

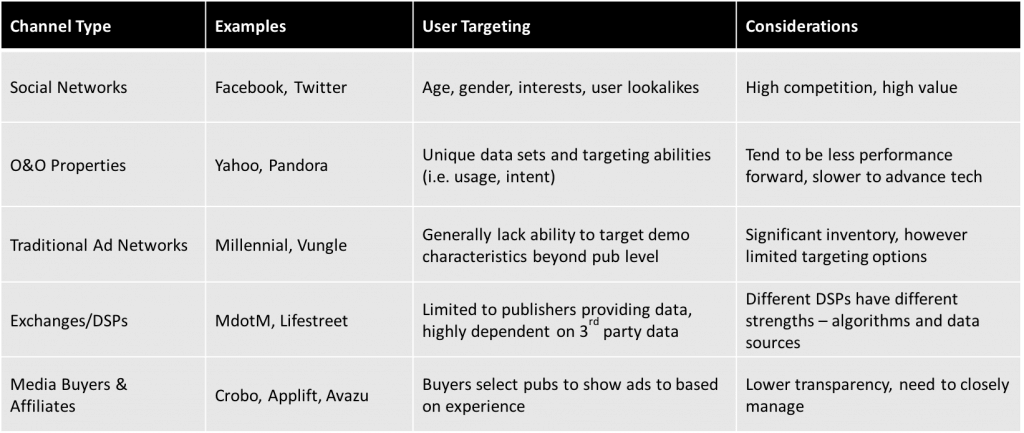

These are broad categories, but I find this outline helpful in matching my priorities with the appropriate channels. The chart is fairly straightforward, but I want to add commentary to a few channels.

Social networks, particularly Facebook, are generally the first place performance marketers look to spend their dollars because they offer the most precise audience targeting as well as high value users. However, social networks are also saturated with competition, which makes it challenging to sustain high returns over extended periods.

Traditional ad networks and exchanges still have a ton of inventory, but lack the ability to narrowly target demographic attributes. I find it to be important to learn what each has to offer and use their algorithms to your advantage, even if they can’t match all of your targeting specifications.

As for DSPs, their strengths vary by company and data source. It’s up to us as marketers to assess DSPs as any other channel, discover how they can help us scale, and choose partners that understand how to help our businesses grow with quality app users, not just installs.

Due to the varying states of maturity of mobile advertising verticals, there is no silver bullet for non-gaming app marketers when it comes to choosing user acquisition channels and targeting people within them. It’s important to consider your user base and what makes them unique when deciding where to spend on user acquisition. Each channel has distinct pros and cons, but if you understand what kind of users you need to grow your business, it makes it that much easier to test, learn, iterate, diversify and best allocate your spend to reach your return goals.