Looking for Love in All the App Places: Men vs Women

Digital dating is big business, to the tune of over $2 billion dollars in revenue per year. As the New York Times points out, more and more consumers are using mobile as the primary way to interact with dating services. Match.com president Amarnath Thombre went on record saying that in 2014 the site had a “35% increase in the people who use Match through the app each month, and a 109% increase in the number of people who only use the app to reach Match every month.”

Behavior differences between genders and the mobile platforms they use can have a huge impact on the success or failure of a mobile app, and these differences are especially important for dating services. After analyzing millions of post-install data points at Liftoff, we have identified some important trends that smart marketers need to consider.

While dating apps must attract both female and male users, the ultimate goal for marketers is the elusive long-term subscriber. True love has a price tag, and it’s not uncommon to see subscription fees for services like Match.com exceeding $30 per month. For a year-long subscription, that totals to $360 in gross revenue for the dating service that finds the perfect consumer target.

However, the perfect user doesn’t always convert into a long-term user. Each of the many steps between download and subscription is fraught with the potential for drop-off. After the initial download, users are busy with profiles to create, potential matches to browse and, in many cases, engaging in some basic forms of communication before they are required to pay a fee.

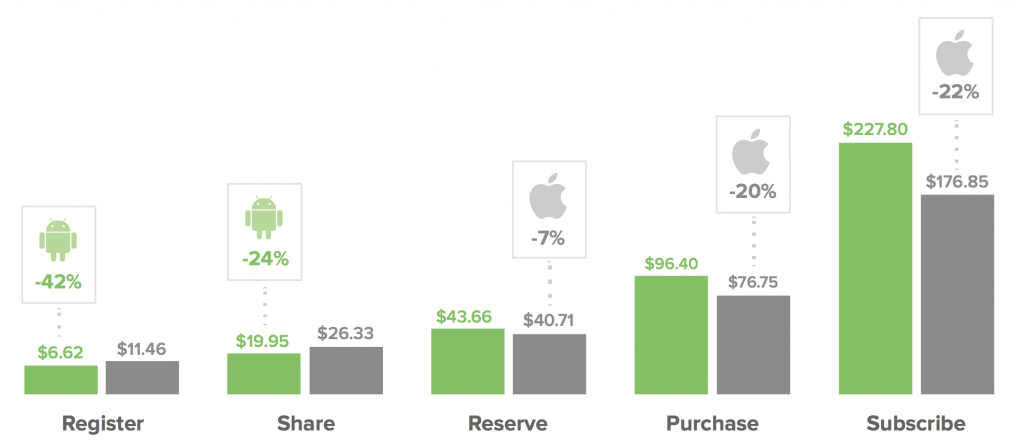

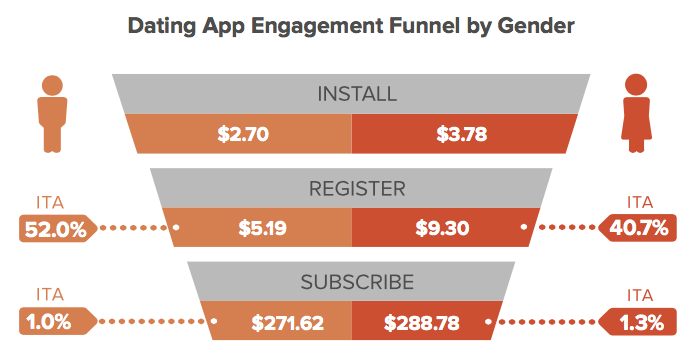

Eager males are more likely to create an account once they’ve downloaded a dating app, with 52% of men registering, whereas only 41% of women will make the same commitment. And not surprisingly, it’s less expensive to get Android users to install and create a profile than iOS users. In fact, from install to the registration, Android users are a whopping 42% cheaper to acquire than iOS users.

Does that mean dating apps should focus most of their advertising on cheap-to-acquire, high-registration-potential Android-using men? That depends on their ultimate goal.

While men are happy to dabble in dating, women are more serious – and engaged – when it comes to getting down to the business of finding a mate. 31.6% more women are willing to pay for a dating app subscription than men. Even at volume, it is difficult for this increased rate of purchase to make up for the significantly cheaper to acquire male registrants, and the cost per female subscriber is more than $15 higher than their male counterparts.

Averages only tell part of the story. Each step along the engagement funnel provides an opportunity for campaign optimization through smart targeting, retargeting and engagement tactics.

If women are more inclined to make the final subscription purchase in dating apps, with Hinge being one of the few exceptions, then one clear way to drive up profitability is to optimize the mobile engagement funnel, focusing on reducing the cost per install and increasing the registration rate on Android, while targeting women over men. This will bring down the cost per install and cost per registration while still targeting purchase-prone women.

This can be optimized further by building out retargeting campaigns that focus on women who have downloaded the app, but have not taken the additional step to register or subscribe. These same retargeting style campaigns can also focus on men who registered but did not activate their paid membership.

Any user acquisition funnel has a number of points between the initial ad impression and the final end target action. Each of these steps provides marketers an opportunity to fine-tune and optimize messaging, creative and demographic targeting. Equipped with the right data, and the right advertising partner, you can guide users down the path to app profitability.