How App Marketers Are Adapting to a Privacy-First Industry

According to Insider Intelligence, users are downloading fewer new apps than at the height of the pandemic. While the market is still set to grow, the mobile advertising landscape looks very different from how it did in 2021. After a turbulent year that saw macroeconomic changes and industry shake-ups, mobile marketers are reshuffling their priorities.

In our latest App Marketer Survey, Liftoff garnered responses from more than 500 mobile app marketers across verticals and company sizes. Marketers shared their familiarity and attitudes toward App Tracking Transparency (ATT), SKAN 4, GAID deprecation, and where they expect their companies to redirect spending in the coming year. Their responses indicate that marketers recognize the value of ad channel diversification, but their priorities still vary depending on budget.

ATT, GAID, and other recent privacy changes

After Apple rolled out ATT in 2021, conversations with mobile marketers have typically revolved around the privacy changes that limit third-party data access. ATT requires users to opt-in to data sharing with apps. For app marketers, this limits segmentation, attribution, and other insights into campaign performance. While overall ATT opt-in rates have steadily increased, rates can still vary significantly depending on app category.

Following Apple, Google plans to phase out its Advertising ID (GAID) by 2024 and to restrict cross-app tracking of users. But to ameliorate the impact of ID deprecation on user acquisition, Google is also developing its Privacy Sandbox for Andrdoid—similar to Apple’s SkAdNetwork(SKAN).

How marketers perceive privacy changes

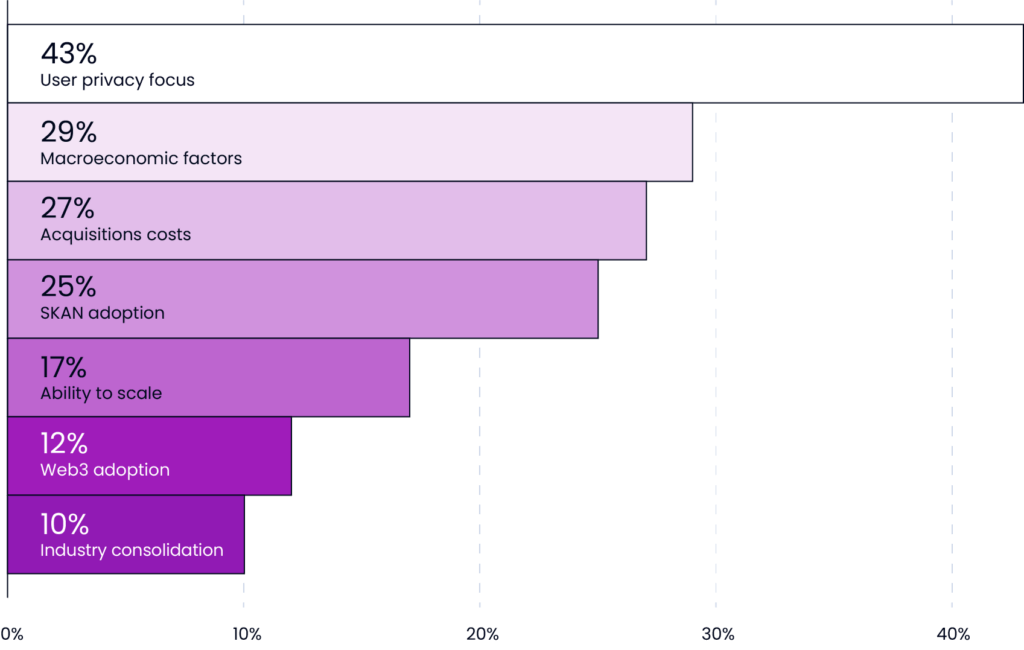

For most marketers, navigating user privacy is their chief concern—above macroeconomic factors and the rising cost of user acquisition. 43% of respondents expect user privacy to be their top challenge into 2023.

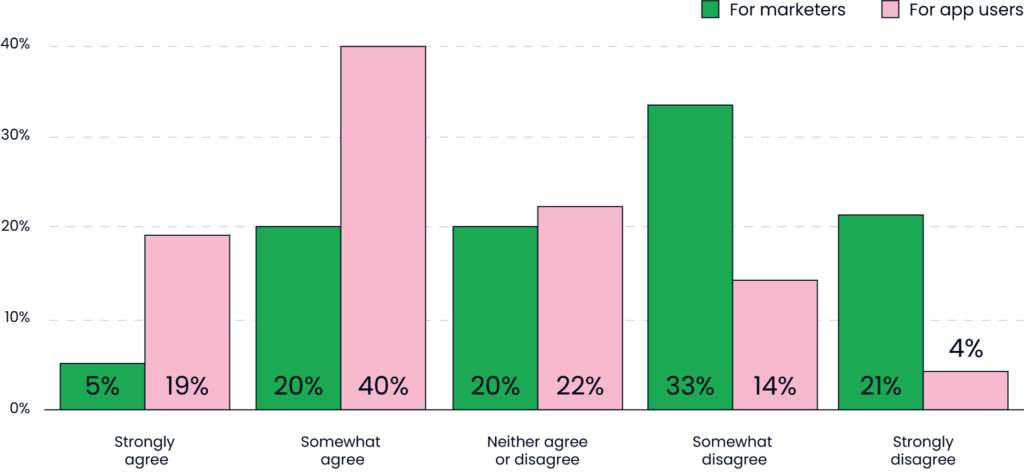

We asked marketers how they perceive new privacy changes including ATT. We found that despite limitations on segmentation and attribution post-ATT, most marketers see privacy as a good thing for customers. But we saw a clear split in perception between what is good for users and what is good for marketers.

59% of marketers agree that privacy changes are beneficial for app users. But only 25% of respondents think privacy changes are beneficial for advertisers. Where user-level targeting was possible two years ago, most marketers are now at a significant disadvantage.

Marketers gauge the impact of ATT on strategy and spend

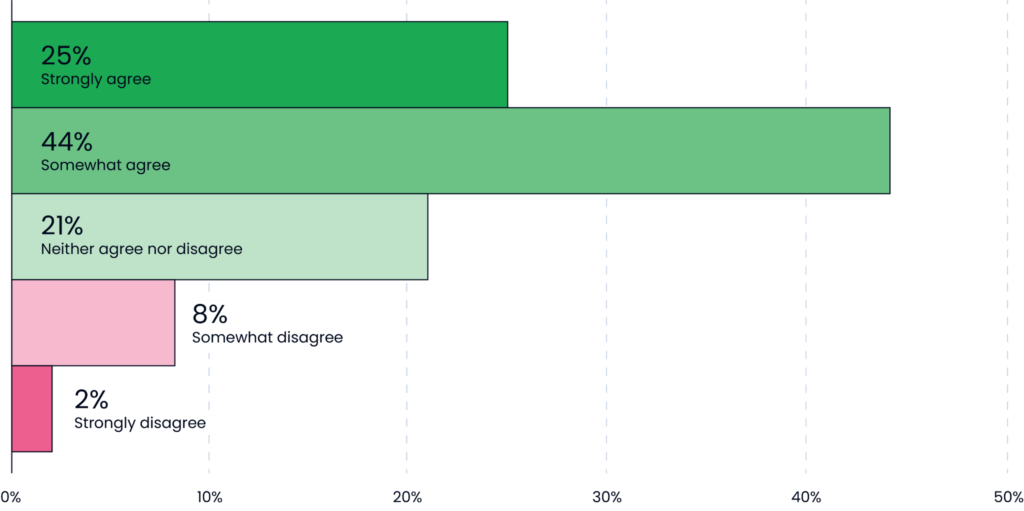

Ongoing privacy challenges also highlight a need to change how app marketers approach audience targeting. Our survey found that many marketers believe the industry is too dependent on user-level data.

70% of survey respondents agreed with the statement: “As an industry, we have become too dependent on the granularity of performance data to accurately gauge campaign success.”

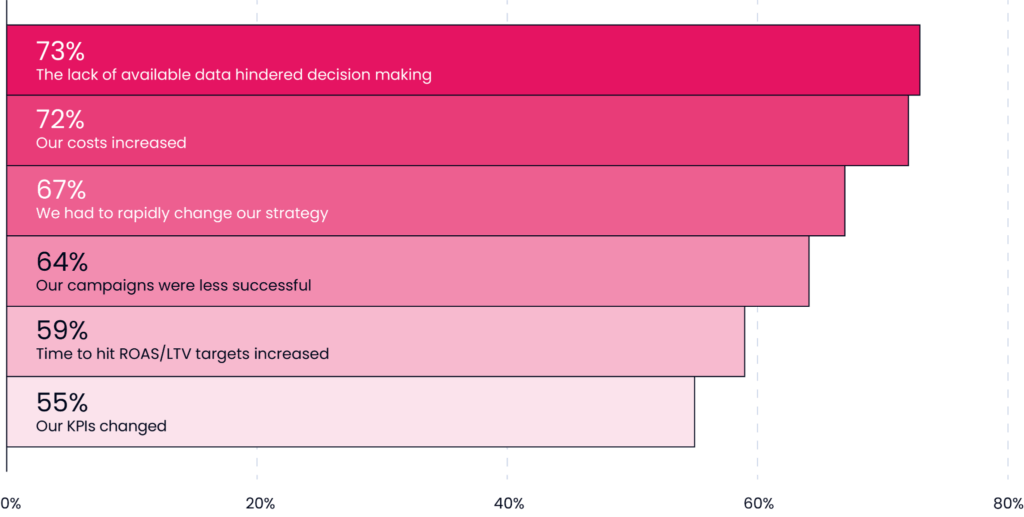

Growing pains are expected as the industry moves away from granular targeting. But respondents were clear about the impact of ATT on their revenue and UA Strategy:

73% of respondents report that a lack of data hinders their decision-making capabilities. 72% saw increased costs post ATT, and 67% changed their strategy rapidly in the past year.

ATT and privacy changes not only affected strategy and planning, they also disrupted outcomes. 64% of respondents said their campaigns were less successful. 59% of respondents said the time required to hit ROAS/LTV goals increased.

Diversifying channel mix to adapt to ATT

Without user-level information, marketers have to increase spend on campaigns to reach and convert the same number users. Insight into UA performance also suffers as companies may lack the tools and know-how to drill into the data they do have.

With costs rising on iOS, marketers report reallocating spend to Android to offset any negative impact ATT may have had. 47% of respondents report spending more on Android since the rollout of ATT.

In response to privacy changes, survey respondents also plan to increase their ad spend beyond strictly UA channels to capture new users.

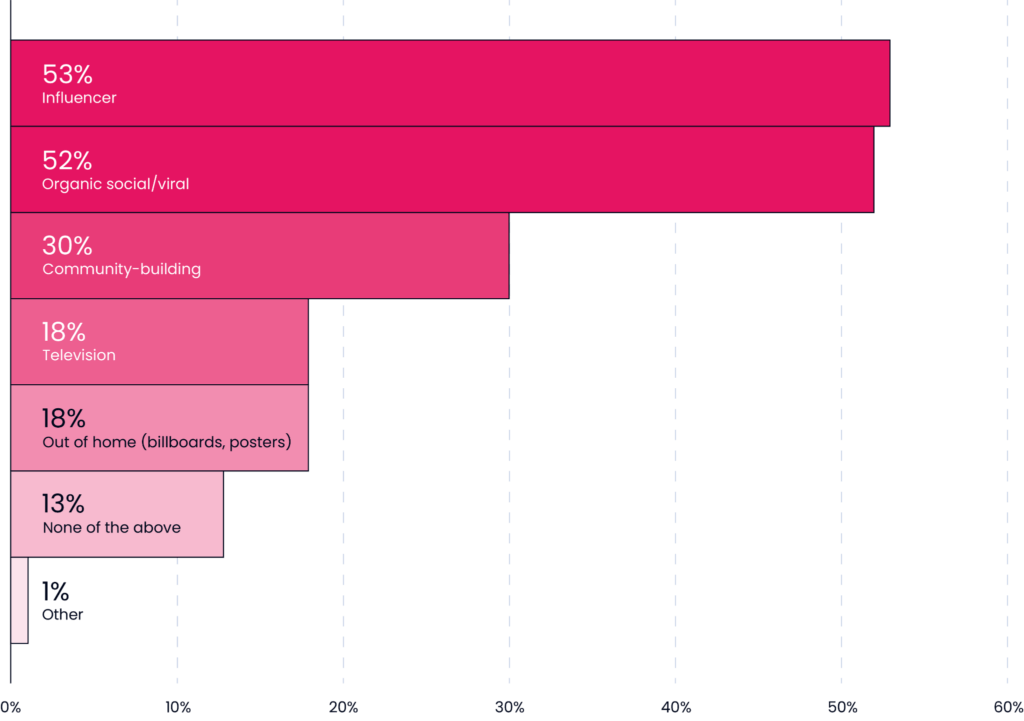

App marketers see organic and influencer channels as top priorities. Most see influencer partnerships as a particularly promising channel. 57% of respondents say they currently use influencer marketing, and 53% plan to increase their influencer spend in 2023.

For more insights into how to leverage influencer campaigns to grow your app, consult Liftoff Influence.

Uncertainty about SKAN 4 and GAID

At the time of the survey, Apple had already announced changes to SKAdNetwork, known as SKAN 4. The changes have since been released. SKAN 4 allows for more granularity while obscuring individual user data. The changes also enable app marketers to measure re-engagement through three postbacks.

While the updates are significant, marketers vary in their knowledge of SKAN 4. Only 47% of marketers reported some level of familiarity with SKAN 4. Opinions also differ on whether or not SKAN 4 will help or hinder user acquisition.

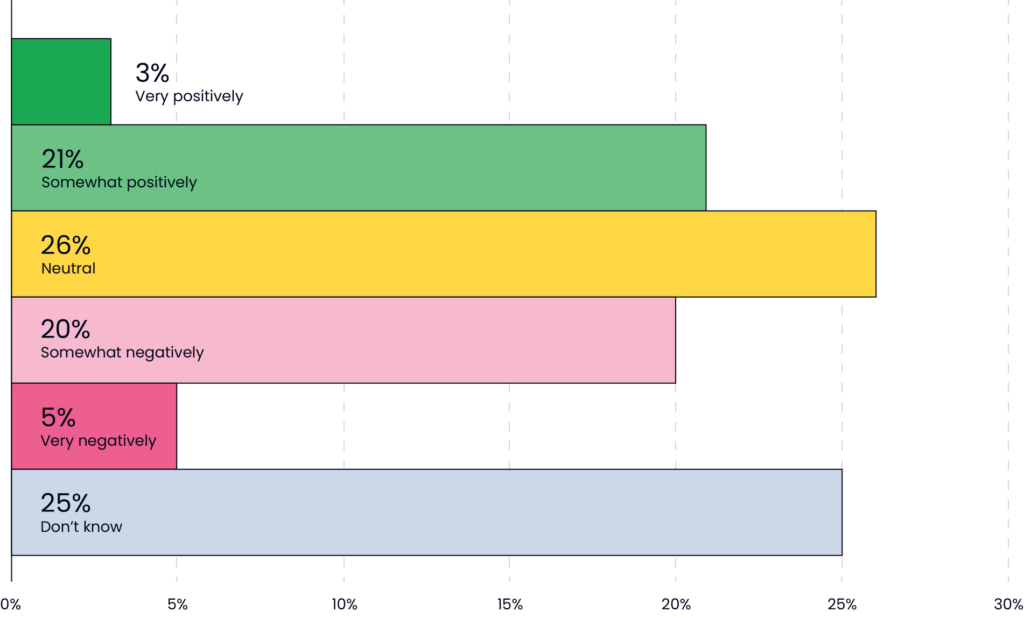

24% believe SKAN 4 will have a positive impact, 26% are neutral on the subject, and 25% are unsure of the effect.

Marketers are also split on their views about GAID deprecation on Android.

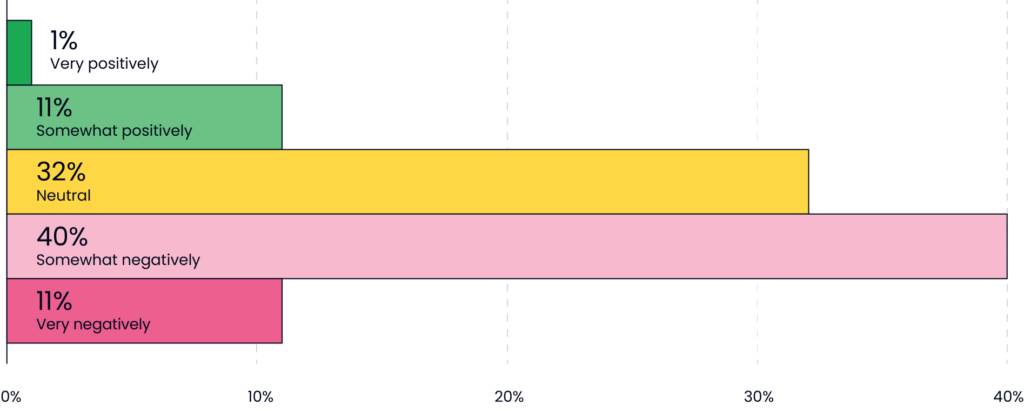

51% of marketers believe that the change will have at least a somewhat negative impact on UA, and 70% report little to no preparation for the change.

Limited familiarity with SKAN 4 and GAID is not surprising. Migration to SKAN 4 will take time, and industry best practices for Android ID deprecation will not develop overnight. But adapting early may make companies more able to capture performance insights. It may also mean less strategy changes later on.

The future of mobile app marketing

With limited access to user data and more privacy changes on the horizon, industry professionals are adapting to privacy-first approaches. For some advertisers, this may mean adjusting ad spend. Our survey found that facing rising UA costs, marketers are diversifying ad channels in order to scale.

Overall, when asked about their outlook for the future, marketers are almost evenly split. 37% saying think 2023 will be smooth sailing, while 36% are preparing for rough waters.

For more on how marketers are feeling, download Liftoff’s 2022 App Marketer Survey today.