Must-Know Highlights From the 2025 Casual Gaming Apps Report

The mobile games market has experienced its share of triumphs and challenges in the past few years. A record number of games crossed the billion-dollar revenue mark, but total mobile game downloads dropped to their lowest level since 2019. It’s a tricky time for mobile marketers and developers alike, and success in this rapidly evolving market requires constant innovation.

The Liftoff 2025 Casual Gaming Report, created in partnership with Singular, explores the key benchmarks and changes to the casual game market from the past year and offers actionable insights from GameRefinery to help you scale your game.

Here are a few highlights from the report that app and mobile game marketers need to know.

Engagement, Cost, and Revenue Trends for Casual Games

Where can casual game marketers see the most impact from their ad spend in 2025? The Casual Gaming Apps report examines several key benchmarks, including Installs Per Mille (IPM), Costs Per Install (CPI), and Return On Ad Spend (ROAS), as places to start. We noted the following from the report:

1. Installs Per Mille (IPM) averages are higher on Android

Installs per mille (IPM) are driven by several factors, including ad creative, strategy, and app store optimization. Across all genres researched, IPM is considerably higher on Android than iOS. Unsurprisingly, casual games (including hypercasual titles) that appeal to a broader audience consistently have a higher IPM than genres like casino and RPG.

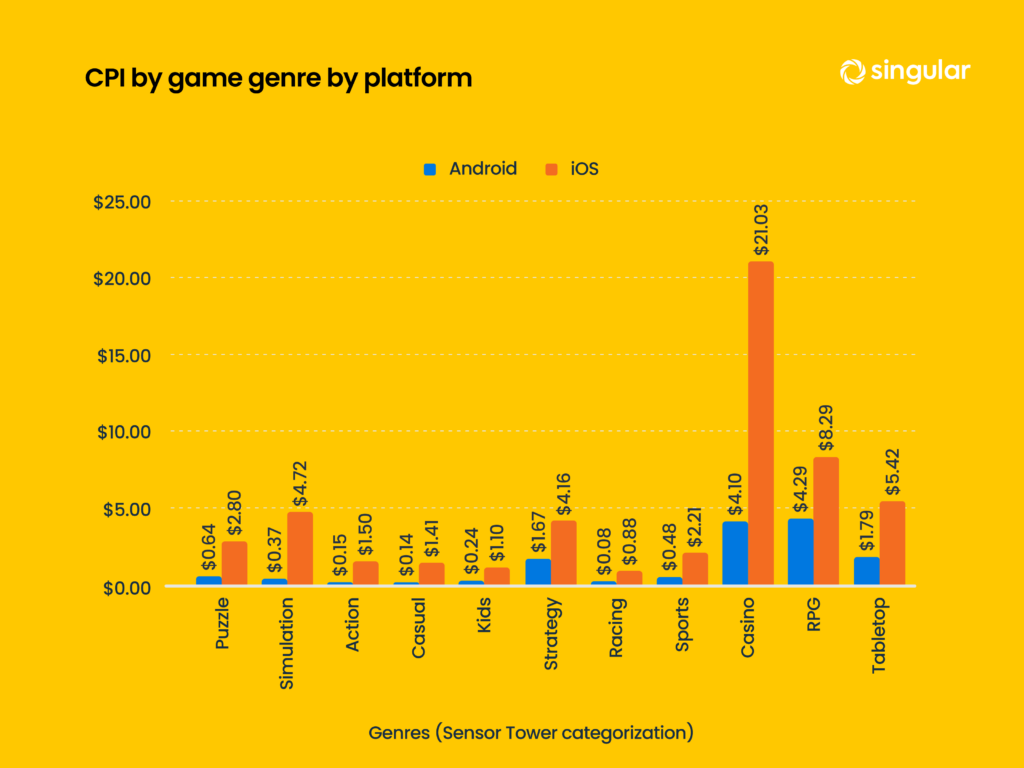

2. iOS acquisition costs are higher than Android

User acquisition costs are on the rise for mobile games across the board. iOS continues to post higher costs per install (CPI) than Android. Simulation, action, and racing games see approximately 10x higher CPIs on iOS.

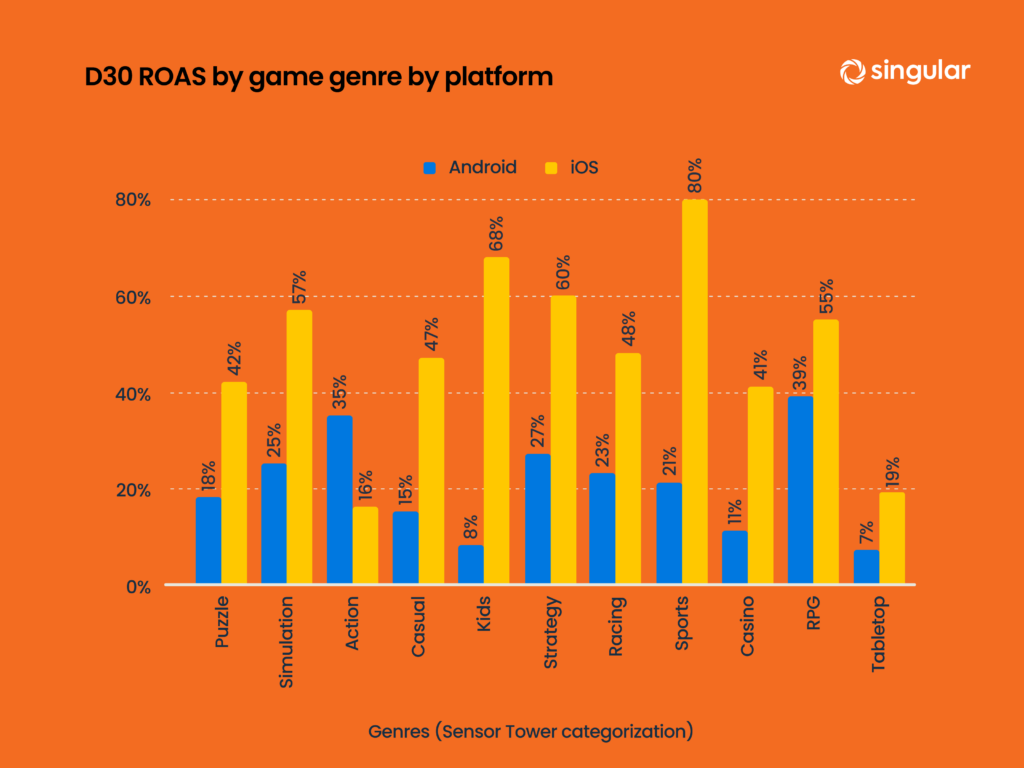

3. But iOS delivers higher average Day-30 ROAS

Although acquisition costs are higher on iOS, iOS users tend to spend more time on average on their phones, make more purchases, and have a higher median income than Android users. As a result, they continue to offer better average return on ad spend (ROAS). For casual games, average D30 ROAS in 2024 reached 47% on iOS compared to 15% on Android, an impressive gap.

Split by genre, sports games see the highest D30 ROAS on iOS at 80%, followed by kids at 68% and strategy at 60%. Comparatively, on Android, sports returns sit at 21%, with kids at 8% and strategy at 27%.

Where Are Casual Game Installs Coming From?

Capturing a new audience is an ongoing challenge for mobile game growth. As the market for non-gaming apps continues to grow, buying ad inventory in consumer apps can do a lot to future-proof your mobile game. Using data from GameRefinery, the report examines which game and app genres drive the most casual game downloads.

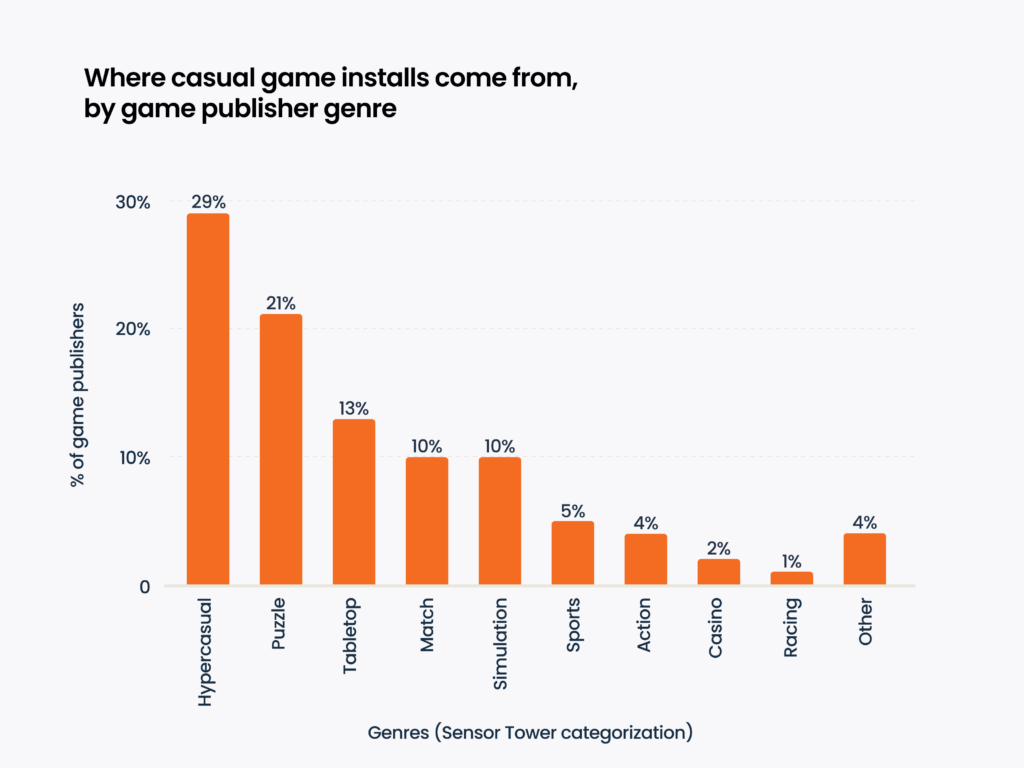

1. Hypercasual games remain the top source for casual game installs

Roughly half of all new player downloads for casual games come from advertisements shown in hypercasual and puzzle games. This is likely due to the high number of these games and their broad appeal. Hypercasual games also rely heavily on in-app advertising for monetization, meaning players simply expect and are exposed to more ads.

Of course, depending on the genre of your game, different strategies can yield better results. Beyond aiming for mass appeal, like also works for like. For example, Simulation games source new players from other simulation games in addition to hypercasual and puzzle titles.

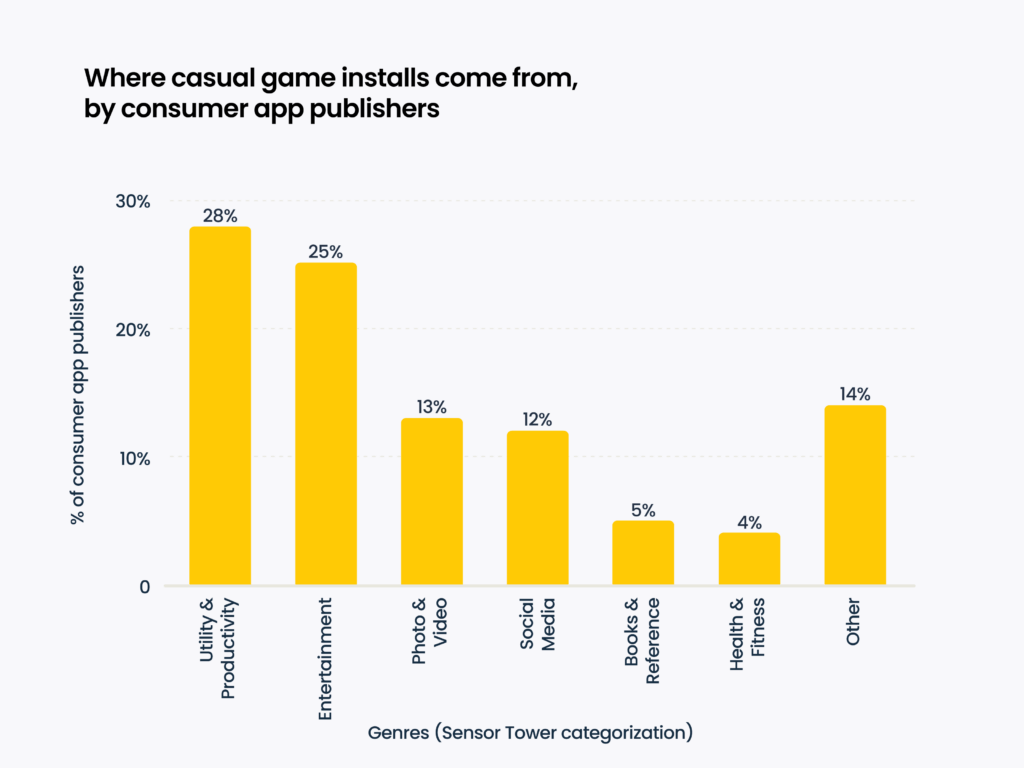

2. Casual games find new audiences in non-gaming apps

‘Gaming works for gaming’ is a tried and true approach, but top games are also reaching audiences outside the mobile gaming ecosystem. Liftoff has found that over half of casual game installs from non-gaming publishers come from utility/productivity and entertainment apps. Social media and photo/video apps also comprise 25% of installs sourced from non-gaming apps

While audience overlaps can be harder to find initially, investing in ads in non-gaming apps is an excellent method of putting your game in front of net new audiences. Of course, working with the right DSP with access to non-gaming inventory will help.

Noteworthy User Acquisition Trends from 2024

Keeping abreast of engagement and UA trends in mobile games is essential to scaling new titles and growing veteran winners. Innovations keep the industry fresh, whether it’s new twists on live ops, minigames, or venturing into hybrid genres. 2024 saw many exciting new trends, but the experts at GameRefinery think these are a few to watch.

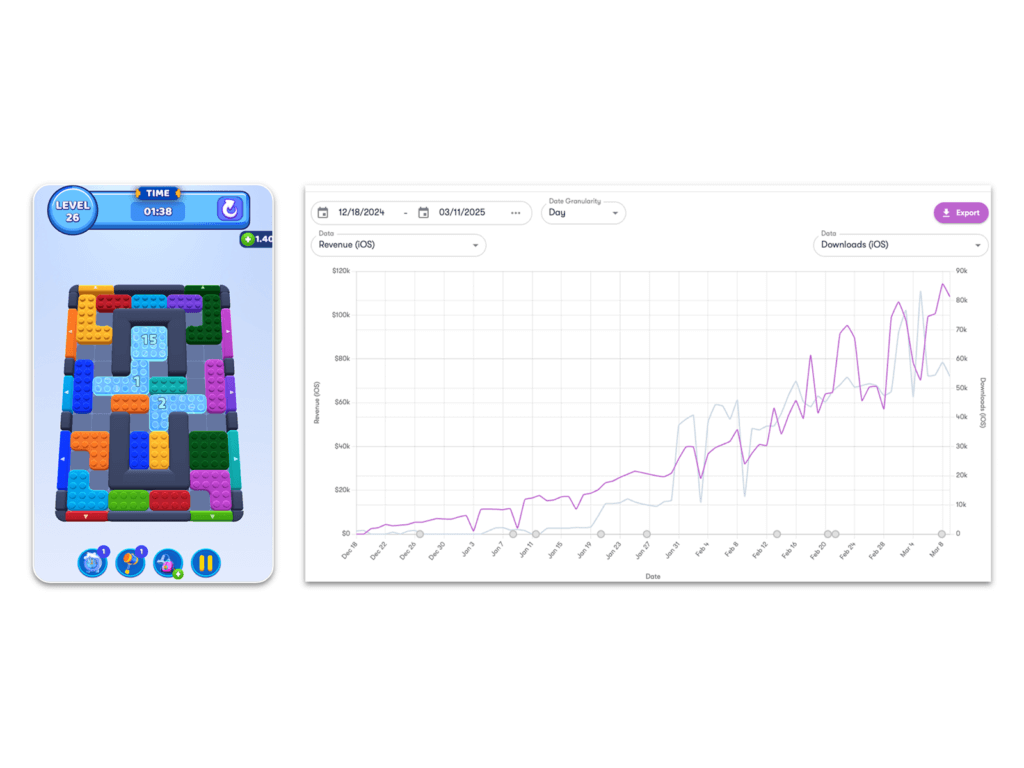

Hypercasual and hybrid puzzles continue to capture audience attention

There has been a significant increase in the combined market share of hypercasual and other puzzle games in the US iOS top-grossing 500. These genres grew substantially, from $4.12 million in the last quarter of 2023 to $13.99 million in 2024.

Following the success of titles like Twisted Tangle and Hexa Sort, many new games with simple yet addictive puzzle gameplay have emerged, often with unique twists to help them stand out. This seems to work, with several titles successfully entering and maintaining strong rankings in the top-grossing charts.

These games benefit from straightforward gameplay without complex features, keeping players engaged with simple live events. They also appeal to a broad audience and do not require a significant time commitment.

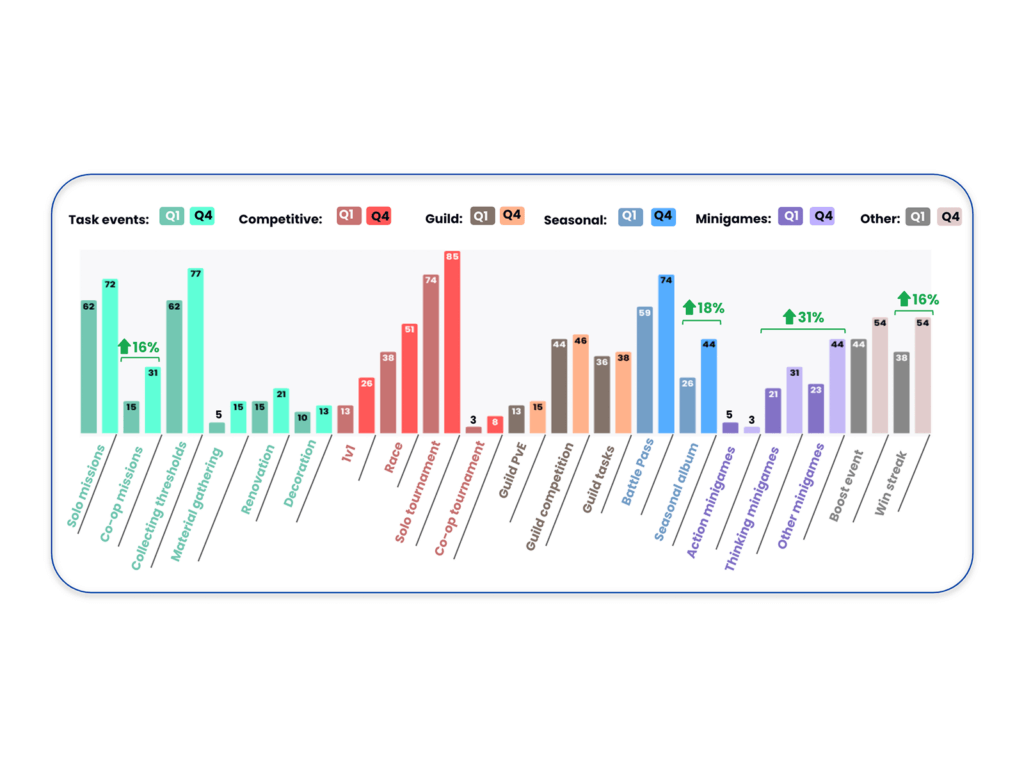

Live events are growing in popularity

Live events have become increasingly popular and are crucial in keeping players engaged and willing to make in-app purchases. Last year, event trends like collectable albums, co-op missions, minigames, and win-streak events experienced significant growth. Social live events have also shifted from guild-based activities to shorter, more accessible co-op missions.

Different types of live ops can be leveraged to appeal to various audiences, with successful titles using several kinds of events, sometimes simultaneously. Minigame events, for example, encourage player investment in the core gameplay loop, extend gameplay variety, and make reward distributions more engaging. On the other hand, win streaks encourage players to spend more and engage consistently to strive to beat out other users.

These events help keep gameplay fresh for players, provide new content to engage with, and help app developers monetize their games.

Innovations in Casual Game Monetization

As the mobile games market continues to evolve, so do monetization techniques. We’ve seen a number of new techniques and strategies boost revenue potential and enhance the player experience throughout 2024 and into 2025. The top ones include:

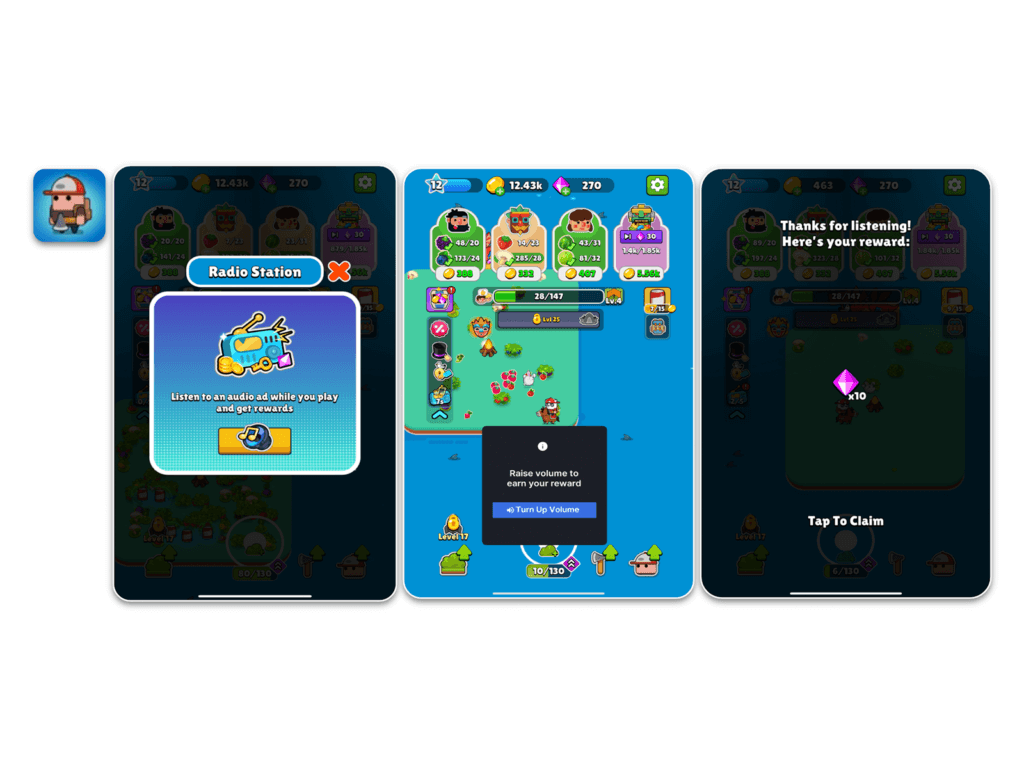

Audio ads take off

Audio ads offer a less intrusive way to advertise in games. Instead of interrupting gameplay with visuals, players listen to ads while continuing to play. This keeps users engaged and avoids disrupting their experience, making them more likely to continue interacting with the game.

Pocket Land is a good example of audio ads being used well. Players are notified before an audio ad begins. They must turn up the volume to get rewards. The game isn’t paused or covered by the ad. This approach to monetization can create a pleasurably nostalgic, radio-like feel for players.

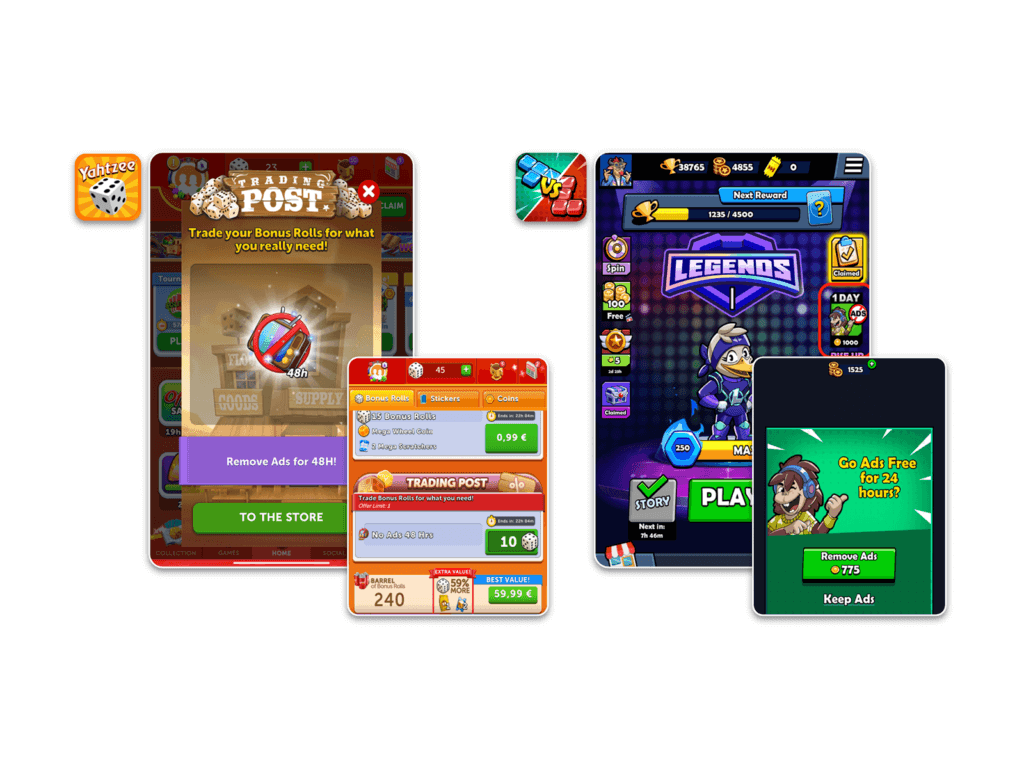

Players make the most of temporary ‘remove ad’ offers

Temporary ‘remove ad’ offers allow players to disable ads for a specific duration using in-game currency earned through gameplay or purchased. This can provide more flexibility and accessibility than traditional ad removal, which typically requires real money to be spent.

The feature also encourages players to engage with the gameplay loop to earn enough currency to remove ads—it may even encourage them to seek permanent paid ad removal in the future.

Customizable IAP bundles

Customizable in-app purchase (IAP) bundles, which let players choose the items they want, are becoming more popular in casual games after gaining favor in midcore titles. While traditionally popularized by more complex games with larger economies, the appeal lies in giving players control over their spending.

There are several different types of customizable bundles. Partially customizable bundles allow players to choose items within a fixed structure. In contrast, fully customizable bundle options enable players to pick items at a fixed or adjustable price. Some more engaging variations even use a randomized selection process, adding an element of surprise before players make their choices.

The “pick-one” bundle also gained significant traction in 2024. Players are typically presented with several different bundles at varying price points, often with a discount offered for users who buy all of them together.

To learn more about casual gaming benchmarks and the UA, engagement, and monetization strategies top games use, download Liftoff and Singular’s 2025 Casual Gaming Apps report.