How to Scale Your Campaigns in Global Markets

Zhi Wei Neo is a Regional Performance Marketing Manager at Tinder, the world’s most popular app for meeting new people. With diverse experience working and living in Tokyo, Seoul, and Singapore, Zhi Wei is a mobile champion of understanding APAC marketing dynamics. Zhi Wei’s firm grasp of cultural norms helps him scale and grow global apps in divided regional markets. At Tinder, Zhi Wei leads performance marketing in Korea and Southeast Asia.

Learn more about Mobile Hero Zhi Wei.

Launching digital campaigns across regional and global markets, once a complex task, is now relatively straightforward. You can set up a campaign through any ad platform, adjust location targeting, and go live within minutes. The ease of going global brings brands of all sizes into the global market, increasing competition and bid prices. But getting to and maintaining a positive ROI across markets is a long process for some brands. Here is what I’ve learned from scaling various tech brands across markets.

The Need for Localization

A seemingly quick way to evaluate consumer interest in your product in new markets is by using existing marketing assets like creatives, product interface, app store page, and social accounts. Within a few days, you can see how well your creatives and conversion funnels perform.

Although this method is easy to kick off, it is unlikely to deliver strong performance—especially in non-English speaking markets. Consumers are used to product offerings in localized languages, both from local players and foreign market entrants. Localization is required to compete effectively in global markets.

English literacy level varies across and within markets. Even if local consumers have high English proficiency, running marketing campaigns in local languages helps build a stronger connection with consumers.

Translations are necessary. But simple translations will not perform well if the messages do not tie in with local insights. For example, existing slogans and taglines in English may not make sense when translated. Or, users pass over plain and simple messages if they do not understand the local context.

Check in with your research team on past local consumers’ sentiments towards your brand to mitigate the issue. Alternatively, search online for research papers and consumer surveys regarding your product category. Use these insights to craft your marketing messages. Messages should ideally be crafted or approved by someone living within the local markets, aware of current trends, and understanding what appeals to the local consumers.

Creative Design

Local consumers prefer a specific creative design style through years of media consumption, including ad appeal, video length, use of colors, and more. While creatives need to be fresh and stand out from the rest, deviating too much from local design standards leads to consumers dismissing your ad. Below are some pointers on how to familiarize yourself with the creative styles in a new market.

- Facebook Ad Library: A good source of ads launched by other advertisers on Facebook. Select your location, ad category, and search for keywords or advertisers. I find it helpful to reference advertisers with large budgets (e.g., FMCG, eCommerce, Mobile Games) as they run multiple A/B tests to find out what works.

- Moat Ad Search: Another great search tool for ads, but the lack of filters makes it hard to identify the location of the ads.

- Social Pages: Check out the social accounts of competitors and high-spending advertisers. Search for ‘brand name’ + ‘target location.’ There will be organic posts designed in a style that appeals to local consumers. Look at the number of likes and comments to identify the winners.

- Media Partners: Request creative samples from ad networks and media partners. Partners have expertise in your industry and markets and can provide valuable insights on creative design. They also advise on the top-performing formats and ad sizes. Talk with media partners to avoid missing out on leading placements.

- When launching a campaign in countries with internet speed lower than the global average, make your creatives load quickly and show correctly. While videos, animations and interactive ads are necessary to build the brand story, try including simple creatives (e.g., static images, text ads) as a backup to maximize ad impressions and reach.

- Using human faces in creatives was found to trigger positive responses in consumers. If you adopt this tactic, consider using local talents and models. Unless you have globally or regionally recognized brand ambassadors, consumers generally connect better with locals than international talents.

- Adapting your creatives to local festivals, whenever relevant, helps integrate your brand into consumers’ lives. Consumers are more favorable during celebrations and likely to spend or try out a new product. Create a local festival calendar to help you prepare relevant campaigns in advance.

- Seek the opinions and approvals of local teams before launching any localized creatives and campaigns.

Other Marketing Assets

App Store and Landing Page

Consider local consumers’ preferences on the videos and screenshots used in the app store. Try testing local vs. foreign models, placement of graphical elements and order of the screenshots. For website landing pages, adopt a layout local consumers are familiar with, reference competitors and run A/B tests to find out what works best.

Potential users may search for your product in English. Therefore, include both English and local language keywords in your ASO and paid search campaigns.

Social Network Profile Page

A profile page is usually required when running marketing campaigns on social networks. For example, consumers might click through to the profile page to check out your brand. If possible, create country-specific profiles and populate them with localized content to connect with local consumers.

Campaign Planning Across Markets

Data is abundant to support campaign planning across markets. In the process, think from both the global and local perspectives to build campaigns that make sense for your brand and local consumers.

Setting your KPIs

A frequent question asked is the KPIs for each market. Some considerations when determining a suitable KPI:

- Cost of Media: CPM varies across countries and impacts CPA. You find CPM benchmarks from industry whitepapers or ask for historical data from the ad networks you work with. KPIs based on CPAs must reflect the cost of media in each country.

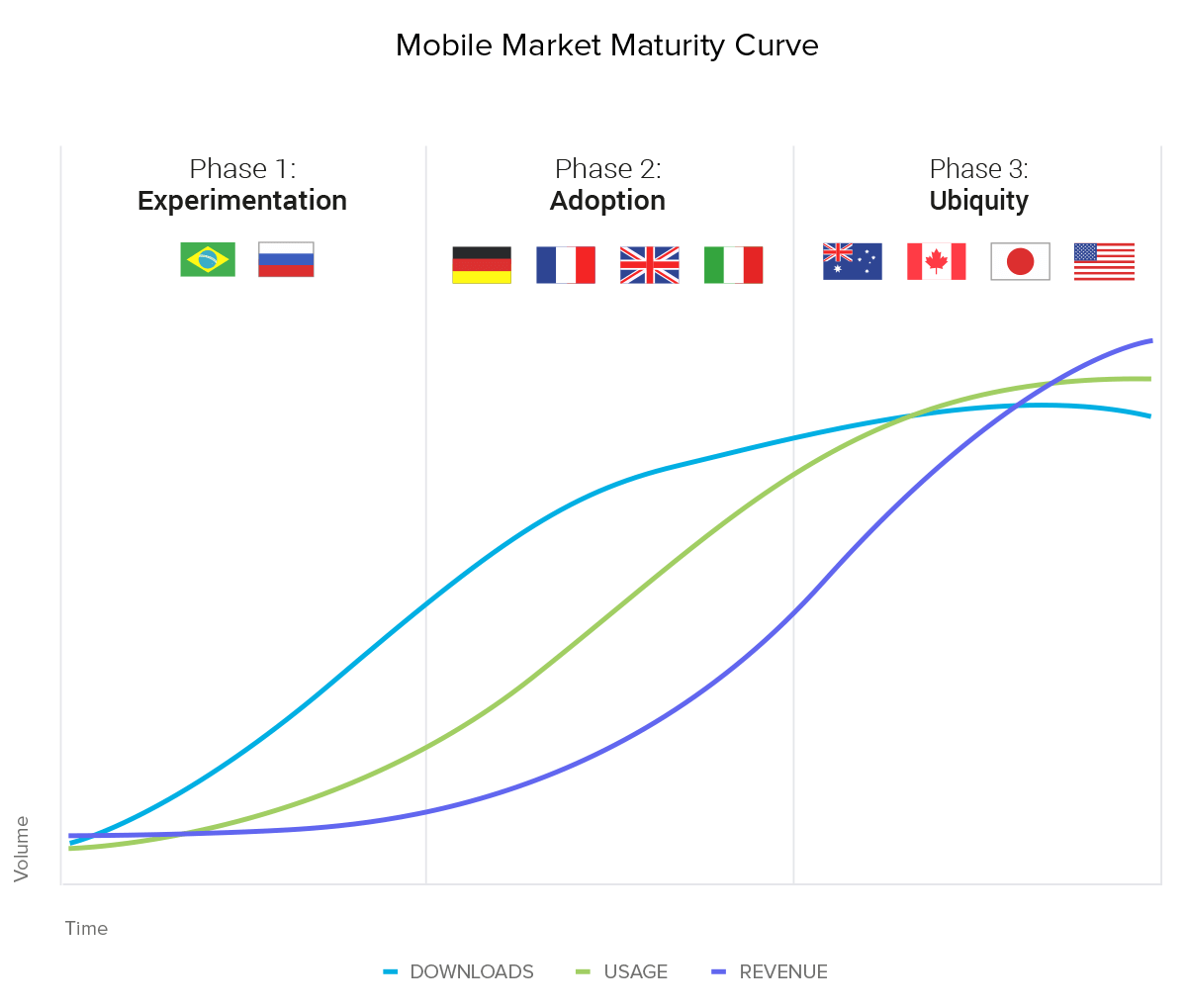

- Mobile Market Maturity: Each country is in a different stage of maturity in the mobile market. The graph below shows an example. For countries in Phase 1, consumers download more apps and spend less than those in Phase 2 and 3. As a result, campaigns running in Phase 1 markets are unlikely to generate a similar level of ROI as those in Phase 3 markets.

Source: App Annie State of Mobile Report, 2019. Liftoff Mobile App Trend Report, 2019

Source: App Annie State of Mobile Report, 2019. Liftoff Mobile App Trend Report, 2019 - Product Life Cycle: Each country is in a different stage of your product life cycle. The time required to move from one stage to the next depends on the marketing budget, product-market fit and macroeconomic factors. A new market is unlikely to generate a similar level of ROI as an established one.

- Lifetime Value: Lifetime value differs for each market. Other than the factors mentioned earlier, the income level of a country will influence lifetime value. Revenue generated from lower-income countries will be lower than that of higher-income countries.

When determining a regional KPI—be it ROI, CPA, or active users—it is essential to consider all of the factors mentioned and make adjustments to suit each market’s unique characteristics. Since market characteristics might change—remember to evaluate the KPI quarterly. For example, the lifetime value of a market may substantially increase after a prolonged period of marketing investment—an increased lifetime value may lead to a higher CPA target.

Budget Allocation

Efficient budget allocation across markets depends on the company’s focus.

Focus on ROI

To maximize ROI, consolidate ROI figures from each country. Then, allocate sufficient budget to the top-performing country while staying within the predicted point of diminishing returns. Repeat this for the second-best performing country, and so on.

- Pros: This is a data-driven approach to help you achieve the highest possible ROI with the budget available.

- Cons: This does not give room for new markets to grow. The markets are constrained by budget and unable to make a substantial marketing push to gain market share.

Focus on Growth Potential

Obtain data on the total addressable market (internal research, industry reports), mobile internet population (WeAreSocial, Facebook Insights), trends in CPM and CPA and competitor actions (AppAnnie). Compare these data of the new markets against existing ones to derive a reasonable budget. If budget is limited, consider focusing on areas of the country with a high concentration of your target audience (e.g., capital cities, financial hubs, university towns)

- Pros: Provides sufficient budget and time to acquire users in a new market.

- Cons: There is no guarantee the budget will lead to a positive ROI in the long term.

The pros and cons make it hard to choose either approach. However, a possible middle ground can be:

- Allocate budget based on ROI for countries considered to be established and mature, thereby maximizing ROI from the budget allocated to these countries.

- Set aside a budget for testing and growth, and allocate it to new and promising markets. Have an agreed-upon target to classify established and mature (e.g., ROI above 25%, MAU above 100k) or a rigid time frame based on past growth markets (e.g., two years).

Media Partners

Regular ad networks provide an accessible entrance into new markets, but they may not bring you the best performance. This is especially true for non-English speaking markets, where consumers prefer local websites and apps. Look into local ad network partners as they usually have a broader reach in the market and expertise on user preferences. Some factors to consider when choosing a local network:

- Audience demographics: Can the network help you to reach your target audience?

- Unique reach: Is the audience size substantial on each operating system?

- Targeting capabilities: What are the targeting splits available (e.g., category, interests, demographics, dayparting, devices, user list)

- Ad format and sizes: Does the network cover the top formats and sizes in the market?

- Ad tech integration: What are the exchanges used? Which DSPs and SSPs are the inventory connected to?

- Measurement and reporting: Is the network integrated with your MMP? What is the methodology and minimum spend required of the brand lift study?

- Brand safety: How is brand safety implemented? Are there 3rd Party Integrations? Is the network integrated with your MMP’s ad fraud capabilities? Can exclusion be done on a keyword, category, or site level?

- Account support: Is there a dedicated account manager to support your expansion into new markets? What is the frequency of performance review sessions?

The setup process with local networks will be challenging due to time zones and language differences, regulations requirements, and ad tech integrations. However, local networks are valuable partners to help you scale in local markets once the initial onboarding is done.

Consolidated Tracking and Reporting

It is not an easy job to oversee the performance of every media partner in each country, even if you have a team to support you. For efficiency, aim to automate data inflow. Accomplish this with established ad networks, either through your MMPs or with an internal data management system. For ad networks that do not integrate, set up a reporting template that allows you to upload to your data management system easily. Align on a currency (usually USD) across networks and countries for consistency. With all data ingested, create a dashboard where you focus on crucial business metrics daily. If there is an unusual spike in specific metrics, you can dig deeper into the country and channels to find the cause.

Key business metrics depend on your brand and industry. However, the following applies to most brands:

- Spend

- Installs

- Registration

- Purchase (and any other key actions)

- Cost per Install

- Cost per Registration

- Cost per Purchase

- Install to Registration Rate

- Install to Purchase Rate

- Registration to Purchase Rate

- Daily Active Users

- Monthly Active Users

- Average Revenue Per User

Filters:

- By country

- By device

- By demographics (gender, age etc)

- By channels, including organic

- By creatives

The recent iOS 14.5 update has impacted some of these metrics, likely understating iOS performance. Speak to your MMP regarding the methodology of tracking iOS performance and reference historical performance to decide on the validity of the data.

Managing digital campaigns across markets is a challenging but rewarding role. First, to scale successfully, invest in localization to build a strong connection with local consumers. Next, consider global and local perspectives with regards to KPIs, budgets and media partners. Finally, simplify your day-to-day by automating data inflow and focusing your time on selected key business metrics globally. Working across markets and cultures has broadened my worldview, and you will find it valuable too.

That’s a wrap from Zhi Wei! Read the latest blogs from Mobile Heroes and join the Mobile Heroes Slack Community to chat with mobile marketers worldwide.